8 min read

Despite popular opinion, a credit card can be a powerful tool for managing your finances when used responsibly. Beyond offering a convenient payment method, credit cards provide benefits like building a credit score and providing a financial buffer when you’ve got ‘more month than money’. The variety of credit card offerings in South Africa means you can likely find one well-suited to your budget or lifestyle.

Before applying, evaluate all the options against your financial status. Then, narrow down the top contenders based on the perks and features that are most important to you. Now, that might sound like a drag, but we’re here to help!

What credit card should I get?

Factors to Consider When Choosing a New Credit Card:

Interest Rates: The maximum interest rate on credit cards in South Africa is 22.5%. Look for a credit card with an annual interest rate of below 15% if possible. If there are any introductory rates, make sure you understand when they end and what the ongoing rate will be. While no interest charges seem appealing, deferred interest cards often have higher rates, so do your homework or choose a straightforward, low rate instead.

Fees: Some cards have no annual fee, which can save you money, especially if you don’t spend much monthly. However, cards with fees often have sweeter perks. Determine if the rewards outweigh the costs and avoid cards with high late fees.

Rewards and Benefits: Now, this is where credit cards shine! For those who pay the balance in full each month, rewards programmes offer stellar perks, so choose one aligned with your spending profile. Also consider bonus categories, sign-up bonuses, and cardholder perks.

Credit Limit: Your credit limit impacts your utilisation and, in turn, your credit score. Look for a card with a limit that leaves room for emergencies while keeping your utilisation under 30% of your total credit available.

Other Factors: Consider the card’s reputation, customer service, mobile features and acceptance. You want a card from an established issuer that treats customers well. It should also be widely accepted and have useful online or mobile apps for managing your account.

Got it? Great! Next, we’ll break down the key features of a few different credit cards based on common spending categories and needs.

The Best Credit Card for a Small Budget

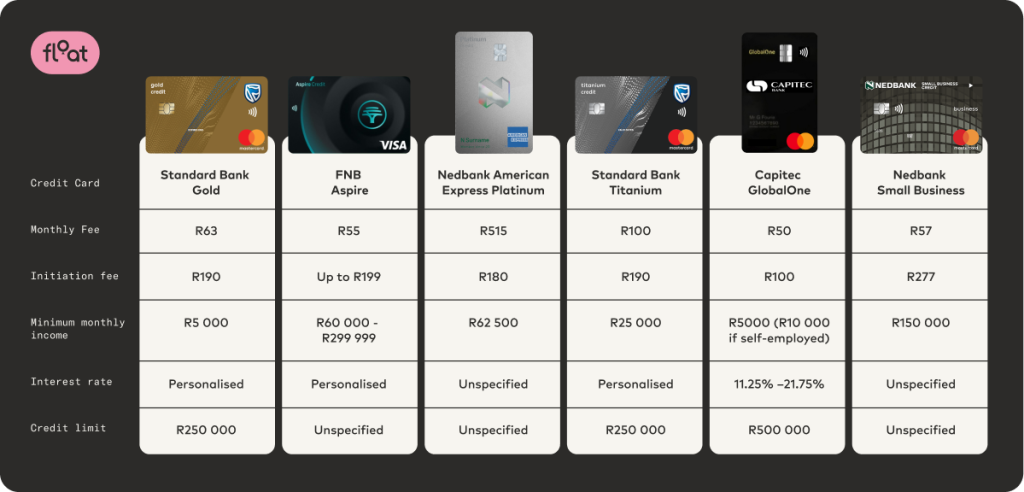

Standard Bank Gold Credit Card

Monthly fee: R63

Initiation fee: R190

Minimum monthly income: R5 000

Interest rate: Personalised

Credit limit: Up to R250 000

The Standard Bank Gold Credit Card’s benefits and low fees are ideal for those watching their purse strings. This card lets you shop in-store or online, tap to pay for smaller amounts, and link to digital wallets while earning some sweet rewards.

With up to 55 interest-free days and a minimum 3% monthly repayment, the Standard Bank Gold Credit Card makes budgeting straightforward, and spending limits can be adjusted upon request to match your needs.

Travel and lifestyle perks are also available with this card. Save on flights through Emirates and Wine-of-the-Month Club orders. Earn 50% more UCount points on qualifying buys, redeemable for travel, dining, and entertainment rewards.

The Standard Bank Gold Credit Card provides a secure way to pay, whether frequenting your favourite local shop or making a once-in-a-lifetime purchase. With worldwide acceptance, your card is ready for any adventure.

A Credit Card with the Best Rewards

FNB Aspire Credit Card

Monthly fee: R55

Initiation fee: Up to R199

Minimum monthly income: between R60 000 and R299 000

Interest rate: Personalised

Credit limit: Unspecified

The FNB Aspire credit card has strong reward potential as it links with the popular eBucks programme.

Earn up to R150 back in eBucks at major retailers like Checkers, Shoprite, Clicks, and Engen. Travel rewards are plentiful, too — get R50 off bus tickets and R100 off domestic flights booked through the FNB app. Frequent flyers can also unlock bonus airport lounge visits when booking flights through the app.

An Aspire account offers a R1 500 Superbalist voucher for big spenders and savers, plus a free smoothie from KAUAI every month. Exclusive offers from top brands such as iStore and Cycle Lab make this card a no-brainer for smart shoppers.

You’ll get up to 55 days of interest-free credit and a minimum 3% monthly repayment with an automatic payment option. The card also includes automatic debt protection and no-charge global travel insurance up to R5 million for the first 90 days of any trip when you purchase return tickets using your FNB accounts. You can also move unexpected medical expenses to a budget account charging prime or prime plus 2% interest.

*Added bonus: Virtual cards enable FNB Pay, Tap to Pay, Scan to Pay, and partner wallet transactions through Apple Pay, Google Pay, Samsung Pay, Fitbit Pay, Garmin Pay, and SwatchPAY! without needing a physical card.The FNB Aspire credit card has some strong rewards potential as it links up with the popular eBucks programme.

A Credit Card with Premium Benefits

Nedbank’s American Express Platinum Credit Card

Monthly fee: R515

Initiation fee: R180

Minimum monthly income: R62 500

Interest rate: Not specified

Credit limit: Not specified

The American Express Platinum Credit Card is ‘The cream of the crop’ for those seeking the very best in travel, lifestyle, and rewards.

As soon as you’re approved, you can earn 30,000 Membership Rewards points with a minimum spend of R10,000.

Beyond the welcome offer, the benefits roll on. Whether dining out, shopping online, or paying bills, you’ll earn 1.5 points per rand spent, which brings you closer to big rewards more quickly.

Get access to over 1 200 airport lounges in 400 cities through Priority Pass when you need a respite before your flight. Locally, enjoy unlimited access to any Bidvest Premier Lounge.

Foodies can also gain exclusive access to the Amex dining programme offering up to 20% off at 30 top restaurants.

For downtime, you’ll receive three months of free streaming on Netflix, Amazon Prime, Spotify, or Showmax after paying with your Platinum Card. And, if you play golf, you can access premium features on the Hole19 app for a year.

Hotel stays earn you rewards and savings at top chains. Your status gets a boost with complimentary elite tiers at Hilton Honors Gold, MeliaRewards Platinum and Radisson Rewards Gold. Exclusive Platinum Rewards at Tsogo Sun Hotels include 15% off dining, 50% off movies, and 10% back in rewards. Plus, save 30% on stays at aha Hotels and Lodges.

This Platinum Credit Card provides flexible repayment options to suit your needs. There are no swipe fees; using the budget facility, you can pay off larger purchases over time. With a minimum 5% monthly repayment and the ability to change your limit, this card makes premium experiences more accessible than ever.

The Best Credit Cards for Frequent Travellers

Standard Bank Titanium Credit Card

Monthly fee: R100

Initiation fee: R190

Minimum monthly income: R25 000

Interest rate: Personalised

Credit limit: R250 000

Want to maximize your travel budget? The Standard Bank Titanium Credit Card is your passport to big savings on flights, hotels, car rentals, and more.

Book an Emirates flight through Leisure Desk and snag up to 20% off. You’ll get the same discount when you rent a car with Avis. Plus, unlock handpicked experiences in top destinations worldwide with Priceless Cities.

The list of benefits goes on. You’ll get up to 10% cashback when booking accommodations on Booking.com. There’s 15% off at IHG Hotels across Europe, the Maldives, the Middle East and Africa. And enjoy up to 20% off flights booked through Travelstart.

Domestic trips have their fair share of deals too. Take 10% off luggage purchases from Gopals while saving 10% off car rentals booked through Rentalcars.com and Budget International — access six complimentary visits to Bidvest Premier airport lounges. Plus, you and a guest get into the exclusive Standard Bank Fluent Lounge at Lanseria six times a year, gratis.

The Standard Bank Titanium Credit Card lets you explore the world and maximise your budget. With worldwide acceptance, 55 interest-free days, a 3% minimum payment, and on-request credit limit changes, this card makes travel easy, flexible, and affordable.

Capitec GlobalOne

Monthly fee: R50

Initiation fee: R100

Minimum monthly income: R5 000 for employed clients and R10 000 for self-employed clients

Interest rate: 11.75% – 22.25%

Credit limit: up to R500 000

With a Capitec GlobalOne credit card in your wallet, you’ll have access to a bigger credit limit and all the perks that come with it. When you use this card to pay, you’ll earn 1% cashback on every rand spent, whether you’re paying online or tapping on the go.

No foreign transaction fees mean using your card abroad won’t cost you a cent more. Your travel insurance is covered up to R5 million when you book travel on this card, giving you peace of mind on your adventures near and far.

You’ll also enjoy 55 interest-free days to pay off your balance, so you aren’t immediately slammed with interest.

If you maintain a positive balance on your card, you can earn up to 3% interest per year.

The Best Credit Card for Small Businesses

Nedbank Small Business Credit Card

Monthly fee: R57

Initiation fee: R277

Minimum annual turnover: R150 000

Interest rate: Not specified

Credit limit: Not specified

The Nedbank Small Business Credit Card provides a flexible line of credit so you can cover expenses as your business grows.

The minimum monthly repayment is just 5% of your balance, so you have breathing room during slower sales cycles. If you pay your balance in full within 55 days, you will avoid interest charges altogether.

You’ll earn rewards on every purchase, too. Get an automatic 5% discount on AVIS rental cars for your team. Purchase protection kicks in for any goods you buy but don’t receive. Plus, you can double up on rewards points for spending on the American Express network.

You even get basic travel insurance included, with the option to add more protections as needed. And spend just R4 000 monthly to access complimentary airport lounge visits.

With this card as a tool, you can have the financial flexibility and rewards your startup needs to thrive long-term.

Choose the Right Credit Card for Your Financial Needs

The credit card landscape offers choice and flexibility today like never before. But with freedom comes great responsibility! This means financial responsibility in managing your credit, paying off your balance in full each month, avoiding unnecessary purchases, and keeping track of your spending. You’ll find the right card if you focus on your needs and prioritise financial well-being.

Consider using a card-linked instalment platform like Float for large credit card purchases. When you pay with Float, you can split big-ticket purchases at all of your favourite stores over up to 24 interest-free, fee-free monthly instalments using the available limit on your credit card. Learn more about how Float works.